Yvonne wrote, “A long time ago, you wrote [this post] about fashion and budgeting. Now that it’s been a few years, do you have any advice or lessons learned to share with us about your money management journey? I know this isn’t directly related to fashion, but young women should try to keep in mind the danger of ruining your credit or not having any savings in the name of fashion (you’d be shocked at the stories I hear from my friends). So maybe like a paragraph or so? Thank you!”

I’ll give you more than a paragraph! Yvonne actually wrote me the above e-mail in October, but I saved this post for January 2013, as I set that date as my goal for getting rid of my credit card debt. I’m happy to report that as of today, I am 100% credit card debt free! Yessss!

Years ago, I was saddled with over $35,000 in debt, spread out over 4 cards. In my 20’s, I wasn’t making a lot of money. With a love for nice things, I bought quite a few items beyond my budget and ran up all my credit cards to the limit. I was fine paying the minimums while working my full time job in New York, but ish truly hit the fan when I moved to Paris for two years starting in 2008. With no job and little income, I had a scary moment one month when I simply couldn’t afford to pay my bills! Thankfully I was able to get on bill payment and tracking plans for all of them, which deducted an amount I could afford at a set time every month. After that scare, I quit using credit cards cold turkey, stopped spending above my means, started paying off my cards in huge chunks, and now, 5 years later (wow!), I am debt free and feeling fabulous! I know some of you are having to refinance student loans and/or take out personal loans just to tread water (on top of lingering credit card debt). So I do have a few words of advice for fellow fashion lovers who want to save, build, and grow both their wardrobes and bank accounts.

1. Don’t buy things you can’t afford.

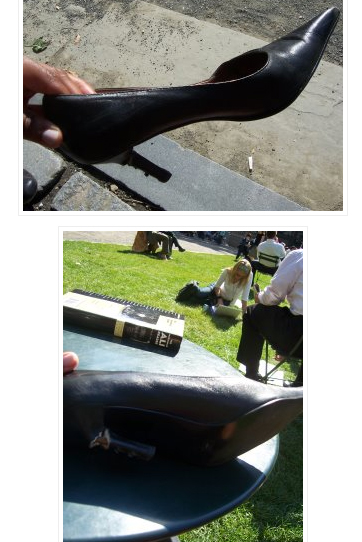

If you’ve been reading this blog from the beginning, you’d remember my tales of shopping on a budget and the Bronx pumps I broke while walking down 6th avenue.

I was an entry level magazine staffer with champagne taste and a beer budget. Back in the day, you’d find me at Loehman’s, vintage stores, and more, because that’s all I could afford. A credit card unfortunately enabled me to buy things outside of my spend zone at the time ($300 Gucci sunglasses, anyone?), and I paid the consequences. If I could do it again, I’d have one credit card around for emergencies (and no, the Louboutin sample sale doesn’t count as an emergency!). Use a credit card if you’re stranded in the middle of nowhere and need to fly back home immediately. Don’t use it because Bloomingdales has a coupon and you found a pair of really cute shoes. After my credit card scare in 2008, I cut up all my cards, stopped using them, and have focused on paying them off. I now only use my debit card, which means that if I don’t have the money to pay for something outright, I don’t get it. Simple.

2. Search out sample sales and get those discount codes.

You’ll find even the most seasoned fashion editor waiting in a long line, just like everyone else, for entry into the hottest sample sales. Luxury costs a lot of money, and lovers of fine things don’t always have the bank accounts to shoulder those costs. You’ve seen me battling the crowds at the Manolo Blahnik sale, wrangling over H&M designer collaboration coats, or popping by Helmut Lang for Friends & Family. Not in New York? Get familiar with sites like Gilt Groupe. Also, set your calendars for sale season. Wait until Black Friday to snag your coat for a deal, or join mailing lists to see when stores like Intermix, Net-a-Porter, and Bloomingdales are having promotions. Shopping online? Before you hit ‘check out,’ do a quick Google search to see if there are any discount codes for the site in question. Usually you can get a quick 10% or 20% off–any little bit helps.

3. Get familiar with vintage and consignment

I’ll be honest: I hate vintage shopping. I can’t deal with the potpourri of possibilities. When I go shopping, I prefer the boutique experience–edited selections with plenty of sizes, or department stores. I just like to know what I’m getting! That said, I still love to pop by vintage and consignment stores for the accessories. In New York, I frequent places like Ina or Fisch for the Hip, as they tend to have *great* sometimes current season designer shoes for a fraction of the retail price. Also, when you start to splurge a bit on your own, you can bring your designer duds there when you’ve tired of them, and make a little change by consigning yourself. Use the proceeds from the sale to get something else you’ve been eyeing. Call it fashion recycling.

4. Go on Ebay or sites like Fashionphile.

While Ebay is prime ground for fakes (I’ve fallen victim), there are several websites that sell authentic luxury goods for less. FashionPhile.com stands out, as they vet all their merchandise, and allow you to pay for authentic pieces over a couple of months.

5. Rent. Rent. Rent!!

I’m no fool! With a myriad of events per week, there’s no way I can afford to buy new dresses, etc, for each engagement. So I’ll invest in shoes and handbags, and if there’s a low key event where I just need something cute to throw on, I’ll Rent the Runway. They have current season styles up to a size 16, and in New York, you can try things on in their fashion closet and take it right home with you (or get pieces courriered to you same day). Also, there’s no shame in Bag, Borrow, or Steal. Though I buy my bags now, back in the day I totally rented my designer bags for, say, Fashion Week, when I couldn’t afford to drop $2,000+ on a purse.

Aside from the tips above, I’d say save your money!! Though I’m not as good as I’d like to be, I automatically deduct a certain amount per month to go into a savings account that I don’t really touch. I use those funds as emergency backup first if anything happens. Now that I’m free of credit card debt, I plan to seriously focus on saving for retirement, and open one card just in case. I’ll most likely be rocking with a card that has fringe benefits–say miles on Delta in case I need a few extra on one of my international jaunts.

In conclusion: A lot of you guys have seen the site and myself grow over the past years. I wasn’t always rocking with Givenchy Nightingales, Kenzo RTW, and YSL Tribtoo pumps! When I first launched the site, I was in my Nine West heels, carrying Cole Haan bags, and professing my love for J.Crew. I still love those brands, but as I’ve grown up and gone for my goals, I now can afford to spend a little more.

Don’t try to live a lifestyle that is not authentic to who you are or what you’re doing.

Don’t try to dress just like Beyonce–she is a multi millionaire and can afford $1500 dresses.

If that’s not your reality, admire, get something similar, or save up if you really want it! If a star isn’t getting an item for free, they are buying it because they can. Rihanna is worth $53 million. So yes, she’ll be rocking a $4,000 coat or a $3,000 bikini.

It’s ok for you to rock with the $40 version. Just know, most times you get what you pay for (reference my Bronx Heels). But if it’s something you’ll only wear a few times, go ahead and get the look for less.

So in sum, if you’re wrangling with credit card debt yourself, my advice to you is: Stop using your cards, unless there’s an emergency. Buy what’s in your budget (it can be done!). And set a goal for getting rid of your debt. Mine was January 2013. And nothing compares to the feeling of not owing anyone ANYTHING. But then, there’s always Uncle Sam. Ha.

So there you have it! Nothing mind blowing, but I hope my words were helpful!

Tell me about your financial journey, your goals, and how you stay fly on a dime.

Smootches!

Great job Claire! Much respect.

Hands down my fave post on FBD. Im one this people with one credit card that always thought about getting another one although I dont need another. This posting put me right back in perspective. I am good at spending and buy luxury items with cash when I can. Thanks alot for this posting.

BRAVO Claire! … Well said, and I totally agree.

I REALLY LOVED THIS POSTS CLAIRE. Luckly for me, my mom scared me when I was younger about using credit cards so I never use my one credit card except extreme emergencies. I love fashion but often get held back because I cant afford it. Once again wonderful post!!!

Please remember people to act your WAGE! lol

Already, the best post of 2013. Awesome tips @Claire, I often worry that some my friends that read this site may lust for the things that are too expensive or stay at every Zara/ASOS sale on ready, without giving a thought to their financial situation.

This insight is much needed, job well done.

Now these are the posts I really like to read! I also invest the most in bags & shoes, but there have been times the heel as broken on some pretty expensive shoes (bar hopping & NYC streets will eat any shoe regardless of price).

There are so many people living above their means & celebrity obsessed who will go into debt to mimic a lifestyle they do not have. I’m a fan of not only Gilt but other flash sites like Rue La La & Haute Look etc. nack in my teens & 20’s when I went shopping I had to spend every last dime. Now, I only get what I need or truly desire. I get what fits me; physically & my lifestyle. I’m not 100% perfect but I refuse to forgo a bill just to buy something or pretend to be where I’m not financially.

As far as clothing, certain items I’ll pick up almost anywhere (black leggings, tank tops, black mini skirts) and I can still fit into juniors sizes, which saves lots of money.

Excellent article!

I operate on a cash/debit ONLY basis as well .. it’s not easy but the debt-free feeling is 110% worth it! :-)

As my mom always says: Act your wage.

Excellent sound advice Claire! Thank you Yvonne for submitting the question that prompted this piece.

I love this post!

I’m veryyyy frugal with my money. Like Kandi says “I ball on a budget”. Although I love clothes and shoes, I would rather spend that money and travel. For my birthday (March), instead of treating myself to a new bag or a pair of Loubs (that I will probably only wear twice) I’m taking a trip to Paris instead.

deeGreat post!

As someone who grew up in a well off family it was innately installed in me to want the best money could afford. I quickly learned when I was disowned by my family to live within my set means. I worked 2 jobs through undergrad, had 930,000 dollars worth of debt by age 22. I filed for bankruptcy by 23. Now I have revamped my life and proven the come back queen after grad school. Even though my money has come back, I definitely limit my splurge items to max 3 a year, I buy basic designer garments that can withstand the yearly trends, I drive the same audi I’ve had since 08 and she’ll have to die on me. Not to mention shopping sample sales and sales period (aside from makeup god sephora has sprinkle sales). All in all, even within your means now could take a drastic turn…

LOVE THIS!! I’m currently working on the same thing of paying down some debt, though I don’t owe very much I just want to be able to live DEBT FREE! It’s so hard to skip the sales & great deals sometimes but in the end it will be worth it!

Great post! Congrats on paying off your cards. that’s my goal for this year…

I truly appreciate this post! Congrats on being debt free!

I am so happy that you did this post! It’s never cute to have a closet full of bags and clothes, but are ducking collectors. I have been credit card debt free for a couple years, and I take pride in paying the balances (in full) at the end of the month. Debt-free lives, let’s get it girls!

Thank you Claire for this post, it’s great that you told your story because it may help a lot of people. With instagram, facebook, blogs, and other social media it gets so overwhelming when you see all these individuals rocking some very nice things and you think to yourself I must be really behind, but what you pointed out is you just never know their story. Great advice, save your money, and stop trying to live a lifestyle that ain’t you. You will be surprised what you can do, and what you can have when your not being held back by debit and bad credit.

This is an amazing post!! I love the fact that you keep it REAL and honest. I have been following you since 06 and I have seen your growth. I am definitely sharing this post. Thanks for posting this :)

This is an AWESOME article. Thank you for this. I just paid off my student loans last year, and it was a year of sacrifice – but so worth it. This year I’m focused on paying off my credit card. Thanks for reminding me that you can be fashionable, but it doesn’t have to send you to the poor house. And CONGRATS on paying off your credit card debt. No small feat, so you have a lot to be proud of. Again, thanks for this piece.

Thank so much for this Claire!!!!! Debt free in 2013, Amen, I never enter the New Year with credit card debt, unfortunately school debt is out of my hands for now. I am grad student that wants to look good but it is important for me to manage for finances for the future so I can own a home and a nice car. Lets stop trying to keep up with Beyonce and Rihanna

you’re so inspiring Claire. i love this post!

Great post and so inspiring! Thank you.

I see all these girls with “red bottoms” etc and im dumbfounded as to how they got the money to wear that stuff. Did they spend their whole entire paycheck? Anyway, i call it “Caviar Taste, Tuna fish money”

Great timing with this post! Perfect advice for the start of the new year!

KUDOs to you Claire!

Best post ever! Luv it!

Claire this is my favorite post! Thank you! We must keep what’s most important in sight. Too many people live by the Carrie Bradshaw quote, “I like my money where I can see it, hanging in my closet.” Those really aren’t words to live by. I like my money available for emergencies, to fund my retirement, and to pay my bills on time so that I can buy a nice house and not a pair of red bottoms. PRIORITIES…I am making sure those are in the correct order in 2013! Thanks again Claire!

I agree @Jackie. My tastes became more expensive once I started reading fashion blogs. I had to learn how to get creative. I can be inspired by a high end look for under $100 and get 1,000 compliments. It also helps that my husband wouldn’t know Prada from Payless.

I love this! A lot of people write about shopping smart but have actually never been through SERIOUS credit card debt. I am so proud that you admitted it and climbed out of it yourself. I made a resolution this year to get my money (credit card debt included) under control in 2013. This was great motivation! Thank you!!!!!

Great article! I have very little debt but I do spend alot on clothes and home furnishings. Almost never full price and I put alot away in my 401k. Ebay has always been good to me (buying and selling), I’ve never had an issue with buying fake items from there, you just have to do your research. Malleries is also good for discounted luxury items. I think cities like NYC are really difficult because we have tons of Sample Sales (YSL, DVF, JCrew oh myyy!) but its about staying focused on your future and what you want.

Thanks for the words of advice Claire. This is def one of the best posts I’ve seen on any blog, ever!

Great post!!!!

I love me some Fashion Bomb Daily. You ladies are the bomb.com. I so needed to read this story. I am going to forward this article to all of my friends now. Thank you.

Love it! Goes hand in hand with what me and my uncle spoke about over brunch on Sunday ; )

Perfect timing. I will be printing to remind myself of my goals to become debt free and stop spending and start saving.

This is such a thoughtful, honest, and necessary post. Claire I applaud you because you are not selling people a dream and this post has excellent advice that we should follow not only with respects to fashion but for us to be economically responsible by making sound financial decisions.

It’s been said (plenty of times) but this is one of the best posts ever on FBD! My mum also scared me about credit cards and often said your ‘flexible friend’ is really your worst enemy. I only have a credit card for emergencies (broken roof etc) and try and save up for big ticket items. Most brands make their money on accessories (shoes/bags/sunglasses etc) as there are so few people who will really spend £5,000 on a dress (hello 1%). I am not a label whore, I’ve friends who work in fashion technology who have trained my eye to look for quality, regardless of what the label says.

Awesome post, very salient statements.

I’d like to see more posts like this, not necessarily fashion on a budget but the team imparting some non-celeb centered wisdom.

Excellent advice Claire. Wouldn’t expect anything else from you. Thanks for sharing your story. I recently became credit card debt free and it’s SUCH a relief. I no longer put things on my card and the sale Helmut Lang pants don’t appeal to me anymore. It’s all about saving. Open an IRA and max it out yearly if nothing else.

…good post…i remember your nine west heels…am so happy for you…lol i buy my designer shoes when they are on sale….i scored a balenciaga for 175bucks on yoox.com…what i do is help people search for designer shoes they want to buy thats more than half the original price….if anyone needs help email me at pi**************@gm***.com

Great post, The fashionbomb is one of the best ,cheers to you Claire !!

Great post, Claire. I’m at the beginning of my financial freedom, and although I’m nowhere near the $35,000 credit card debt you faced, it’s still a daunting task. I can only imagine how freeing it must be to have absolutely no credit card debt! I wanna be like you when I grow up lol.

Great article Claire!! This really needs to be published in as many mags as possible. Many ladies of the younger generation (and some 30+ alike) really need to read this. 2 thumbs up!

Claire- THANK YOU, THANK YOU, THANK YOU for this. I love your transparency and your honesty. I love nice things as well but alas cannot afford them. I love labels (well I love quality) and cannot always afford it and I love these ideas you have offered. Please do more Claire’s life posts! I only come on for those now as the rest is so Kim K and Beyonce saturated. Thank you again for this!

This was an excellent post Claire! I just paid off my credit cards in Novemeber last year so I definately know the feeling. I only use my credit card now for online shopping and travel and I pay it off every month. I will never have that type of debt again! This article is so powerful for women of all ages!!!

Great post, Claire! It’s great to hear your story. I’ve been reading this blog since 07/08 and I’ve definitely witnessed your taste in fashion and the blog grow. I’m glad that you were able to let women know that there is a way to look great without spending money you don’t have.

This was well needed, back when I was a commercial banker (I’m an investment banker now, yay!) I would deal with so many young sisters living beyond thier means. I know in this economy its hard to pay your bills, save, shop, and play all @ the same time but you must prioritize. Don’t try to dress like the celebs. I was on a date with this guy and I told him about my shoe addicition. He asked me did I own any “Red Bottoms”. I told him there is no way I would buy those shoes if I didn’t own property. And he was in shock. I go by what my Dad always told me. “Don’t go broke trying to look good. Buy the best YOUR money can afford”. So I don’t buy LV I buy MK lol Great post!

Great post Claire! thank you for your honesty and fashion tips.

Really great post Claire! It’s clear you really took time to write this.

Congrats on clearing your debt!

Great article. Thanks for the excellent tips.

AMAZING POST!!! I to recently paid off my credi card debit (amazing to see all that extra money in my account) but, I’m currently still Sallie Mae’s biotch and will be for a while….

Great advice. I especially love the Rent the Runway promo. I often have engagements so this tidbit is greatly appreciated. My goal is to also be completely debt free by June 2013. But of course there will always be those dang student loans! LOL

#OperationCutCards

Claire, this post was so helpful and a lot of things you spoke about is so me. I’m working on it in this new year so help me god. You inspire me in many ways, it isn’t even funny. I love you baby girl, keep being you. xoxoxo

THANK YOU CLAIRE!!!!

As everyone else has mentioned this is an awesome post. As a reader of your blog since it’s beginning it is great to read your personal story, and its also uplifting to read about a successful woman reaching out to help and give advice other women.

*to other women

Very helpful post. Loved it!

This is so true… Sometimes, you have to live in your bracket. There is enough clothing out there to fit every woman of every income.

I loved every word of this, Claire. It was firmly rooted in reality, and very much inspiring. Thank you for sharing!

Bravo Claire! I think this was much needed and an important article for you to post. We often get caught in the glamour of celebs/fashionistas on Youtube and blogs that we forget that reality of financial freedom! I am working on that this year and saving more! Keep up the good work!

you are an inspiration! i am also paying down my debt and i only have one credit card. i stay “fly on a dime” by only shopping sales and thrift stores. i reconstruct my vintage pieces when i want to emulate a designer look. the key to shopping thrift stores is to only buy unique pieces, such as a great wool coat or a beautifully constructed dress :-)

wait…in your 20s??? aren’t you still in your 20s..hot dang, i thought u were 26ish. next post do a “how to look like your in your 20s and your not”

Thanks so much Claire for this post. I agree with an earlier commenter, these are the types of posts I would like to read more often. You give a “real world” perspective for navigating the fine line between one’s taste and one’s means. My husband and I have also had dealt with credit card debt in past years and we are now “practically” credit card debt free…only one card payment away. We’ve also got a great head start on our retirement as well. So Claire, I feel you. It’s a Wonderful feeling to be on this side of credit card debt. Also, like you we have also gone to consignment stores, as well as put things on consignment. I find if you have “an eye” for quality items, you can navigate those stores quite nicely and often find a “hidden treasure” every now and again. Again great post and I would love to see more like it in the future. *SMILES*

Hey Y’all thanks for your kind words! This post has been cooking in drafts since October, so I’m glad I could finally hit ‘publish’!

LOL @Liz Since I keep it 100 with y’all, I’ll disclose I’m 31, turning 32 on Saturday #OW Capricorns, stand up!!!! So I’m not far from my 20’s, but ya know…started The Fashion Bomb at age 26, 6 years later, voila!

At any rate, keep sharing your stories, you inspire me as much as I hope my story inspires you. X

Dope post!! This is definitely the type of post that so many of us (myself included) need to read. Thanks for being so honest and sharing. Happy New Year!

Congrats on being debt free Claire….my debts come from all this schooling I’m paying for. But I’ve always been very frugal with my shopping. I know that one day I’ll be able to afford the things I really want. And yes, I only have one credit card that is maxed out! That’s only because I was using it to pay bills while I was unemployed. But Praise The LORD, I’m doing better now,

Blessings

Og dear, this was me last year. Lovely tips Claire. You’re the bomb.

Oh dear, this was me last year. Lovely tips Claire. You’re the bomb. xx

Thank you Claire for this post. I needed it! This will be a post I will surely revisit.

This was a really amazing article. May I ask what company you used to pay your cards off. I have a friend with this exact problem and I would love to pass along the sound information.

@M Don’t use a debt consolidation company. I repeat. Do not use a debt consolidation company. I considered doing that when I felt things were gong over my head. Debt consolidation companies basically charge you money to do something you can do yourself.

Call all your credit card companies and discuss setting up a payment plan. Most credit card companies I dealt with (Bank of America for one) had some sort of hardship program you can enroll in. I was paying what I could afford every month; I had to do that for 2 years before I got back on my feet. Then, once I could, I paid it off. It’s intimidating, but everyone I spoke to seemed very willing to help. Just don’t let your bills go unpaid for long. As soon as you know you’ll have a problem/won’t be able to make a payment, call them up and see what can be worked out.

Good luck!

Great question with a very thorough answer. Thanks, Claire for being humble enough to share your experience.

Thanks for the post Claire and congratulations! For the younger ladies (I’m over 35) I caution you to not rack up debt, save and invest while you have little to no responsibilities. I opened a mutual fund in my early 20s, by my late 20s I was able to use that to put down on a house. Pay off your car. Clothes, bags, shoes and these other trinkets are worthless – investments are lasting, can be resold and you can pass on to your children or family members. Don’t get sucked in to what the t.v., videos, magazines and even some blogs are doing – be the millionaire next door!

I think to take this article to the next level..may be do a piece about why people feel the “need” to rent, charge or wear things that they can not afford?

What has happened to people that they are willing to pay 1k and up for shoes?

finally a dose of reality

This was excellent Claire. And kudos for paying off your credit card debt and being debt free. I’m on my way to being debt free. I paid off all of my credit cards and my car about 3 years ago but I’m still working on my student loans. I should have one loan paid off by october. You have given me some sound advice that can really help me.

Thanks Claire. This article is definitely helpful. As I’ve been wrestling with this subject I’m glad to have these resources.

oh.em.gee. Thank you for bringing this finance thing back into perspective for me! I too was scared by my fam early on, so I’ve avoided credit card debt but the lack of ability to fashion splurge can truly be heartbreaking, so thank you for the reminder that Madewell is a perfectly acceptable jumping off point! :)

Great tips Claire! I can’t stress the last one enough people need to stop imitating the life of the rich and famous especially when they get most of their stuff for free while we are penny pinching trying to keep up. Furthermore stop chasing trends! If you must do a trend try stores like forever 21 or something so once the trens is finally over it won’t feel like you wasted big $ on it. I need to get my college debt down sick of being sally mae’s trick…lol

I really needed to hear this thank you so much Claire!!!

Great post Claire.

@ Claire Fantastic post. People need to learn and hear that you should never, never live above your needs. Celebrities loan clothes, and get them for free when they don’t buy them. Don’t try to compete with friends, colleagues or the hot chick in school. Stay true to yourself and you will be able to sleep well at night.

If you want something work for it and save every penny for it. I live my life by these standards and that is why I have no credit card debts.

Make sure that you have friends/family around you that will encourage you to save and be careful with your money. Sometimes it is the company you keep that has bad influence on your spending. If it is the case, get rid of these so called friends.

Last if you owe money, don’t act like they will disappear on their own, call your debitor, try to set up a payment plan, and stick to it. Don’t use any third party. Do it yourself, it will save you money in the long run. Remember, if you cannot afford it, it is not worth it.

This was an awesome post!! And thank you to the young lady who had the courage to ask about such a sensitive topic!!!

My biggest fear is making out. I am close to $4,000 in credit card debt and I am BEYOND stressed about paying it back considering I have no stable job right now. But reading this post really put things into perspective for me. I can pay it off in a few months once I land a decent paying job so that makes me feel a little more content (and I’m optimistic things will change soon!) and my fear of maxing out definitely prevents me from spending more on those cards. I’m no where near maxing out but I definitely know the dangers I could place myself in and my mother has schooled me on what can happen so I’m glad I’ve realized my bad habit early on. I have so many more important things I want, like a car and to move out on my own and not have to rely on my mother, so that’s driving me to be more responsible. Thank you, Claire for this awesome and insightful post :) may God continue to bless you and your loved ones!

A lot of us don`t like to share our personal financial situations with each other; so, thanks Claire for sharing with us! Congratulations on paying down that debt. I can relate to racking up debt in my 20`s. It felt like such a relief when I pay it off by my 30th birthday. This is a post I would have loved to read when I was in my twenties. I guess we live (in my case shop) and learn!

Congratulations on paying down debt! That is an awesome accomplishment! You forgot the trusted ebates where you get cash back for your online purchasing. That with a coupon gives you HUGE savings! I am also a Coach girl. They have an invite only section where their one year old or older purses are for sale. Coach I find is timeless so it doesn’t matter to me if the style is a year old. I get my purses on average for $100.00.

This is what makes your blog >>>

Great advice Claire, especially for a student like myself!

This is a great piece Claire. Big time Kudos and congrats to you. I plan on having my student loans paid off in with years. It takes the big time step of cutting back on shopping. I guess I have always been good a thrift and vintage shopping so it wont bother me that much.

fantastic post!

great article!

I love this Claire! It’s great to see a young black woman taking charge of her finances. I am all about maintaining good credit and watching how much I spend out of my bank account. I love the clearance rack and I know when sales are and what kind of discount they will offer even if I don’t participate lol. Clearance racks always carry the trend and style I’m looking for and I don’t have to worry about spending an arm and a leg. I shop online at my favorite department stores because I know they will carry my size and I can get free shipping because I carry a credit card and I am a preferred shopper. I am really looking forward to improving both my wardrobe and credit score in 2013!

Hi Claire,

This was a great post. i am actually interested in finding out how to find out about sample sales. Is there a listserv or site?

Unfortuneately, I’m guilty of breaking every last one of these rules. But 2013 is my year to get it right!

Congrats on being debt-free. You’re financially and physically healthy: a blessing to hold on to! Glad to see so many responses to an important post. By the way, I only know a few vintage shops online and none of them are CHEAP unless they have sales…which is when I pounce :lol:

Wow Claire! Thank you times a million for this post. I really do like shopping for fashionable finds and can appreciate this little bit of yourself that you’ve shared. I am currently paying off my credit cards and two of my student loans because I graduate this fall and want to be ahead of the curve. I do love a lot of the things you wear but also realize a lot of it comes from you working your way up the ladder. I will be credit card debt free by the end of this month and focusing on paying off my car.

As far as my way to stay stylish on a budget, I re-read and analyze all three of Nina Garcia’s books from The Little Black Book of Style and the Style Strategy because she really makes you pick investment pieces and tells you where you can splurge and where it’s best to save. I also edit my closet ruthlessly three times a year to consign or donate things that don’t fit or haven’t been worn in 6 months. I recommend her books to EVERYONE because it makes me re-think my purchases. Thank you again for talking about finance and fashion :)

Claire u dont know how proud u make me ! And am only 17

These are the kind of posts we all need to read to start the year. All the fashion is great, but we need to know how to get it for less. Letting us know how to save on fashion is a great start to the New Year. I live in LA and discovered fashionphile a couple of years ago, a great source to save on luxury items. How about skin care posts this year? Claire, you are the best!!!!

Best post Claire and congrats on being debt free

CLAIRE IM SO TOUCHED BY THIS ARTICLE. THANK U FOR SHARING YOUR TIPS AND YOUR JOURNEY ON THIS IMPORTANT MATTER! FASHION LOVERS LIKE US DEFINITELY NEED TO KNOW THESE THINGS! THANK U SOOO MUCH FOR SHARING THIS!!

Well put Claire!

Another thing for those who want to get their debt down more don’t fringe on getting a second job in a field that always interested you, for school debt there ate volunteer programs thay help you pay a portion of it, getting a job working online or making money off of your hobby. There are tons of avenues to tap into to make more money so don’t sit on your hands being crippled by debt. Looking at your debt number is a duanting tasks but cutting it down or eliminating it doesn’t have too.

And why was I thinking of the Proud family episode of when penny got her credit card…lol

This post is everything Claire! I truly appreciate your honesty; definitely a reality check for me. My goal is to pay off all my debt by the end of June 2014, and I’ll be bookmarking this post for continued inspiration. :)

I don’t have any credit card debt, I’m actually trying to build up my credit. I appreciate your honesty and your advice! Maybe you should do a financial post more often. Some people feel they have to keep of with the Knowles, but you don’t have to spend like one! I shop in many different places: consignment, thrift, vintage, dept store or chains like H&M. I agree that you get what you pay for which is why I stopped buying cheap shoes too. In the end you just have to keep replacing them! It’s better to spend a little more on what will last longer.

great post claire. i do believe in balling on a budget because it is absolutely possible. congrats on being debt free!

Amazing advice from a class act! Thanks for your positive contributions of beauty, grace, fashion, and intelligence.

AWESOME POST!!! I’m close to being debt free myself! And I would definitely suggest investing in a credit card with flight benefits! It can help you save even more in the long run!

Yes! Do not use debt consolidation companies! They put me back in the rear but thank god I was smart enough to let them go and just made arrangements with the credit card companies individually!

That was very inspiring. Thank you for sharing your story for so many others to learn from.

love this. thanks and many blessings in 2013 and beyond!!!

This was a very great and informative article; thanks Claire!

Thank you Claire for your personal story. I can’t relate to being in debt but I certainly am broke! lol! I recently graduated from college and I am unemployed. My savings are dwindling and affording a fashionable wardrobe is hard. I too like other frugal readers shop at stores like HM, F21, etc. I find this post to be honest and refreshing so much so that I hope it spreads like wildfire. I suggest to other readers in the same position to try threadflip.com. You can buy and sell new or used clothes at great prices. The extra cash in my pocket is helping every bit.

Yeah, I used to be vested in saving up and buying designer when I still lived in London, but travelling around Europe has really opened my eyes to the fact that my financial priorities are not related to designer ware or fashion, but to creative clothing that represents what I feel inspired by. I think, TBH, women buy a lot of items for the affirmation they hope to gain from others. If your closet’s contents were to be destroyed overnight, would your social circle stay the same?

A great post Claire. i love how you urge young women to realise that expensive acqusitions come with time and working hard. you cant be straight outta varsity and rocking Loubos lest you end up livin on beans and toast. many thanks

A very needed and great post with real life example of you.

Great. I would also like to add that when i see a designer piece i must have i try looking for a replica or cheaper versions and usually i dont get this (fustrating) but i usually bump into another style e.g i like a designer top with prints but i see the almost identical print in a dress form what i do is i cut the dress and make it into a top.etc so learning how to be creative, learning to cut and basic sewing should be a must for fashinistas on a budget.

Loved this Clarie! So inspiring! I love how we have grown with you. I don’t pop in as often to fashionbomb as frequently but I remember way in the back back days how you rocked affordable and classy styles. <3 congrats again!

another tip is sell your car….especially if you live in the city…either way Claire you did this

I’m late but I truly LOVE this post! It’s good to be fashionable & financially ‘responsible’ with the decisions we make. To add, another thing you can do on a budget (especially if it’s a super-tight budget like mine right now), is shop your own closet! I’ve grown to LOVE repurposing items I already own and doing new things with them to meet with the trends! Thanks Claire for this post! =)

LOVE this post!

ummm…JCrew is considered high end on my budget. :\

I love this. I used to save $200 a week but decided to put that towards my bills. Braces, Student loans and Credit card. I’ll be done paying everything off by the spring.

When Im done paying those off., I’m gonna buy me a nice LV bag since the money is in my saving. It’ll be my first designer anything. I can’t wait. I always wanted one but didnt want to be the chick who with a bag she can’t afford.

GREAT POST

I would like to see more articles like this…. real fashion articles & tips for real people.

Oh my god Claire, this is so honest of you. Well written, very very useful,so true, so real. I’m so glad you wrote this and I’ll keep all this in mind this year. Thanks

This post really hit home with me and I am soo happy that you were open enough to share the story of not so glamours times with your readers, you offer some awesome tips that I will be implementing in the years to come

Love this post

Great post!! Thanx for sharing!!

Claire, thanks for being transparent and honest. I like that you clarified what an emergency truly is. I am practicing a “no buy” January and it is interesting to note the things I would have purchased that I do not need. Thanks for the advice.

I really appreciate you sharing your story

Puts things in prospective…great read!